betpuan.site

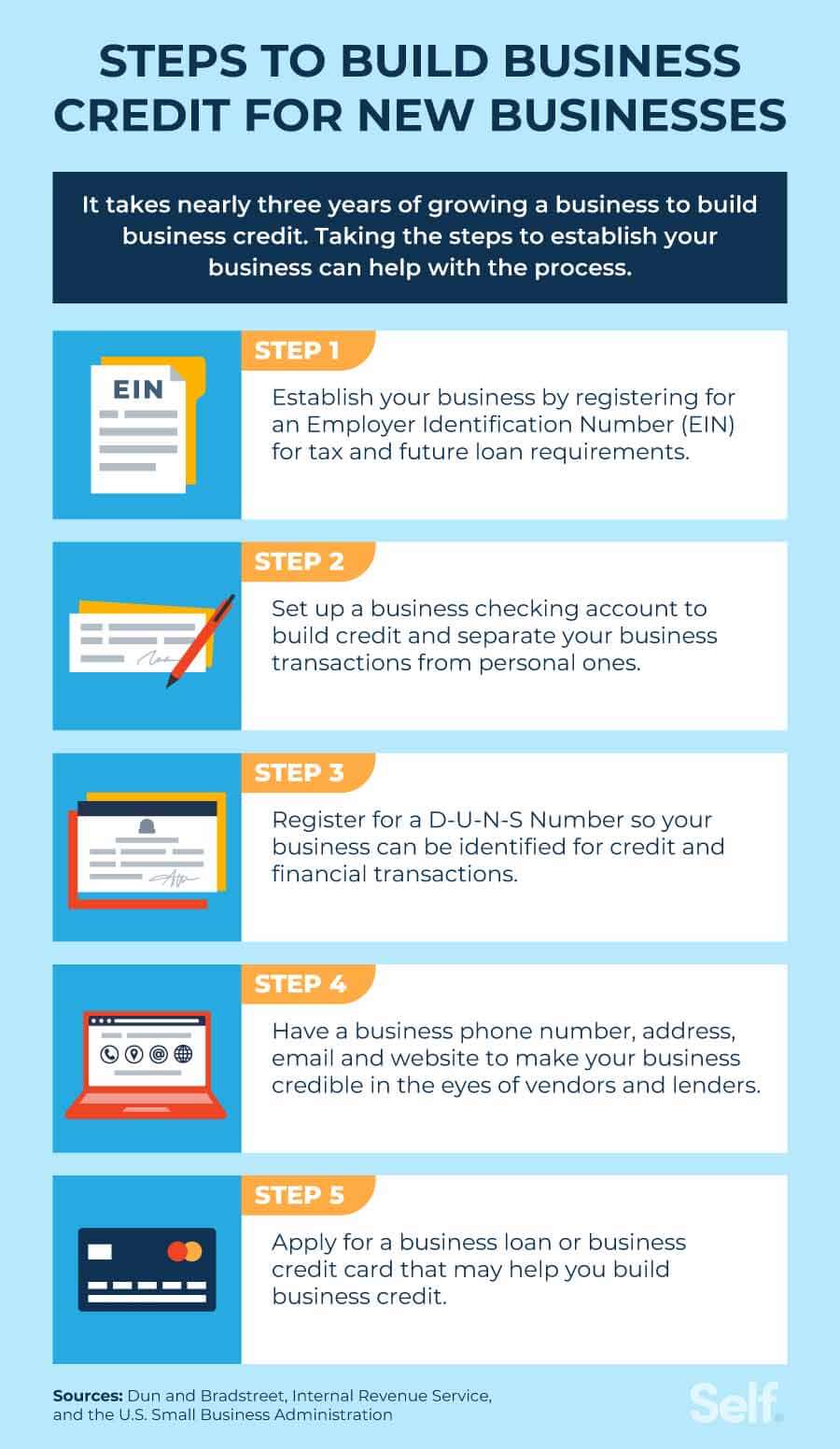

Market

Best Way To Build Small Business Credit

To boost your credit, you need to borrow from lenders that report to credit bureaus, and credit cards are a helpful place to start.2 Open a business credit card. However, entrepreneurs focused on building their business credit should choose accounts that report. Having one or more reporting accounts with payment history. How to “quickly” and efficiently establish business credit. · Make sure you have an EIN for your LLC. · Get a DUNS number. · If possible, obtain a. How to build business credit, raise your credit score, and get funded. · 7. Make repayments on time (or early) every time. · 8. Apply for loans with lenders who. Opening a business credit card is one of the fastest ways to build business credit, as you don't need a business credit history to apply. Credit card companies. 12 Companies That Help Build Business Credit · 1. Credit Strong · 2. eCredable · 3. Lenders, Credit Card Issuers, and suppliers · 4. Uline · 5. Quill · 6. Grainger · 7. This separation of owner and enterprise is often the best approach when looking to establish your business credit. On the other hand, sole proprietors may find. Incorporate your business. · Obtain an EIN. · Open a business bank account. · Establish a business phone number. · Open a business. The first step for how to build business credit is to set up your business Fundability™. In practice, this means as a small business owner you will need to get. To boost your credit, you need to borrow from lenders that report to credit bureaus, and credit cards are a helpful place to start.2 Open a business credit card. However, entrepreneurs focused on building their business credit should choose accounts that report. Having one or more reporting accounts with payment history. How to “quickly” and efficiently establish business credit. · Make sure you have an EIN for your LLC. · Get a DUNS number. · If possible, obtain a. How to build business credit, raise your credit score, and get funded. · 7. Make repayments on time (or early) every time. · 8. Apply for loans with lenders who. Opening a business credit card is one of the fastest ways to build business credit, as you don't need a business credit history to apply. Credit card companies. 12 Companies That Help Build Business Credit · 1. Credit Strong · 2. eCredable · 3. Lenders, Credit Card Issuers, and suppliers · 4. Uline · 5. Quill · 6. Grainger · 7. This separation of owner and enterprise is often the best approach when looking to establish your business credit. On the other hand, sole proprietors may find. Incorporate your business. · Obtain an EIN. · Open a business bank account. · Establish a business phone number. · Open a business. The first step for how to build business credit is to set up your business Fundability™. In practice, this means as a small business owner you will need to get.

8 ways to build a good business credit score · 1. Establish your business as a separate legal entity · 2. Open a business bank account · 3. Pay bills on time · 4. To maintain strong business credit, the best thing you can do is to pay your bills on time to build a positive payment history and monitor your file to ensure. With strong business credit scores, your company can more easily secure business loans or other types of financing and negotiate better credit lines and terms. Use credit responsibly While the preceding steps lay out the path to establishing business credit, there's a crucial component to establishing good business. One of the most powerful tools you have when building credit is simply paying your bills. By paying your bills in full and on time, you're proving that you can. Eight steps to establishing your business credit · 1. Incorporate your business · 2. Obtain an EIN · 3. Open a business bank account · 4. Establish a business phone. How to build small business credit: a checklist. · 1. Create a separate business entity. · 2. Obtain an employer identification number (EIN). · 3. Open a business. Applying for small business credit cards (with a line of credit) is a very good way to build business credit quickly and separate business expenses from. Step-by-Step Guide to Building Business Credit · 1. Establish Your Business as a Separate Entity · 2. Register for a Dun & Bradstreet D-U-N-S® Number · 3. Open a. In the beginning phases of your small business, banks won't offer you credit in the name of your business alone—you'll be required to demonstrate your. How To Build Business Credit · Your business credit score provides banks and other lenders with an idea of how risky a proposition it is to offer your company. 5 ways to build your business credit · 1. Open a business bank account. An obvious but important first step - opening a business account introduces your small. A Step-by-Step Guide to Establishing Business Credit · 1. Establish Your Business as a Separate Entity · 2. Register for a Dun & Bradstreet D-U-N-S® Number · 3. How to Build Business Credit · 1. Develop a positive relationship with your business banker · 2. Establish and maintain credit accounts · 3. Make payments on time. Similar to personal credit, most business credit score goals can't be reached in 30 days. It is good to set those goals though and work towards them. Established companies seeking smaller amounts can apply for a small business loan. Such financing is often available quickly via an online application and can. 1. Understand the importance of a business credit score. · 2. Get recognized by business credit bureaus. · 3. Get (and use) a business credit card. · 4. Develop. Your best bet will probably be using trade credit. Depending on your supplier, you may be able to get trade credit without a personal credit check. Disclaimer. Many small business owners use their personal credit to start or help run their businesses. However, if you can establish and build your business credit. To select the best type of account(s) and the best financial institution for your business, do research online, but also consider talking to local banks in your.

Pulsz No Deposit Bonus Codes

Purchase bonus, 15 Sweepstakes Coins ; Daily login bonus, The quantity of Gold Coins is based on your login streak ; Minimum deposit, No minimum ; Minimum prize. 1. Harrahs Casino. Established Hide Details. Get 20 Extra Spins No Deposit Needed + % up to $ and Free Spins · Play Now. Must be. New players can use Pulsz promo code BONUSPLAY for SC free instantly on signup. That same promo code unlocks a first-purchase bonus: 15 SC free with a $ Explore the latest promotions at betpuan.site! Get exclusive offers on your favorite slots and other fun casino games NO PURCHASE is necessary to enjoy betpuan.site Use our Pulsz promo code: 'CORGBONUS' for k GCs and Pulsz free Sweep Coins. Use our promo code CORGBONUS to get , Gold Coins and Pulsz free. Well, newcomers can claim 5, Gold Coins (GC) and (SC) for free, with no deposit or purchases required. If you do purchase, however, there's even more up-. Pulsz Free SC Promo Code Claim The Latest Bonus from Pulsz Casino & Get Free SC With No Deposit. Get the best social casino experience with betpuan.site We offer + social casino games, including Slots, Poker and Roulette. Claim Free Gold Coins! The no deposit bonus at Pulsz is reserved for new players, providing them with Sweepstakes Coins and , Gold Coins. Is there a VIP program at Pulsz? Purchase bonus, 15 Sweepstakes Coins ; Daily login bonus, The quantity of Gold Coins is based on your login streak ; Minimum deposit, No minimum ; Minimum prize. 1. Harrahs Casino. Established Hide Details. Get 20 Extra Spins No Deposit Needed + % up to $ and Free Spins · Play Now. Must be. New players can use Pulsz promo code BONUSPLAY for SC free instantly on signup. That same promo code unlocks a first-purchase bonus: 15 SC free with a $ Explore the latest promotions at betpuan.site! Get exclusive offers on your favorite slots and other fun casino games NO PURCHASE is necessary to enjoy betpuan.site Use our Pulsz promo code: 'CORGBONUS' for k GCs and Pulsz free Sweep Coins. Use our promo code CORGBONUS to get , Gold Coins and Pulsz free. Well, newcomers can claim 5, Gold Coins (GC) and (SC) for free, with no deposit or purchases required. If you do purchase, however, there's even more up-. Pulsz Free SC Promo Code Claim The Latest Bonus from Pulsz Casino & Get Free SC With No Deposit. Get the best social casino experience with betpuan.site We offer + social casino games, including Slots, Poker and Roulette. Claim Free Gold Coins! The no deposit bonus at Pulsz is reserved for new players, providing them with Sweepstakes Coins and , Gold Coins. Is there a VIP program at Pulsz?

Get all the latest Pulsz Casino bonus offers & Pulsz promo codes from betpuan.site Use the no deposit bonus code to sign up for free and start earning free SC. Right now, players can sign up using the Pulsz bonus code BONUSPLAY to unlock free Sweepstakes Coins. You'll also have the option to claim one of two first-. The Pulsz Bingo no deposit bonus can be used to play for fun by playing various slot and bingo games. However, the Pulsz no deposit bonus has to be played. Create an account with one of the leading sweepstakes casinos in the US today to relish the generous welcome offer. New customers at Pulsz Casino can claim. The good news is that there's no bonus code involved in the no deposit offer at Pulsz Casino. So, you have to complete only a few simple steps to redeem the. Claim our Pulsz promo code 'COVERSBONUS' to get Gold Coins and Sweeps Coins when creating a Pulsz Casino account with the sweepstakes operator. No Pulsz Casino bonus code is necessary to receive the new player sign up offer or purchase bonus. Simply create a Pulsz Casino account, use the Pulsz Casino. Bonus Code No Code Needed Play Now! Must be 21+. Gambling problem? Call or text GAMBLER. Since launching in Are you wanting to find out what the best Pulsz Social Casino bonus codes are and what rewards they can unlock? Our guide is your key to finding out! There are no play-through requirements attached to the promo code bonus. To redeem SCs for cash, you only need to wager them at least one time. Promotions for. Social Casino Bonus: Enjoy Pulsz No Deposit Bonus Sweeps Coins Pulsz Casino offers new customers , GC and SC to kick start their adventure within. After registering with the Pulsz Bingo promo code 'SBRBONUS' and completing the rest of the first step, you will receive your no-deposit welcome bonus of 5, When you enter the code, you'll automatically receive 7, Gold Coins plus free Sweepstakes Coins. You will also be automatically eligible for the first. To claim the casino's welcome offer, click the % bonus pop-up and choose a package to purchase. If you need to, enter Pulsz bonus code BONUSPLAY. Pulsz. No Deposit, No Problem: Get Pulsz No Deposit Bonus Code While most social casinos offer players a 'no risk, no reward' gambling experience, Pulsz. Pulsz no deposit bonus grants you 5, Gold Coins and Sweeps Coins just for signing up. The Pulsz promo code you should use to claim this offer is PROMOGUY. No Deposit Bonus Codes Uptown Pokies. The reels will then spin, Californians can play casino games online for fun at social casinos like Pulsz pokies and. Get SC Coins: betpuan.site Pulsz casino free sc, pulsz real money, pulsz sign up bonus, pulsz reviews, pulsz sister casino, pulsz no. These codes are a gateway to enjoy gaming at sweepstakes casinos without upfront investment. This article provides a comprehensive look at how these bonuses. Yes, the 5, GCs + 2 free SCs no deposit bonus is reserved for newly registered players only. You can't claim this deal again with the same account. You could.

Broad Form Liability

A broad form property damage endorsement was an addition to a commercial general liability (CGL) policy that eliminated the exclusion of property as part of. ISO BROAD FORM AGREEMENT · accounts, bank notes, bills, bullion, coins, currency, deeds, evidences of debt, gold other than · animals, birds, or fish; · aircraft. Broadform insurance is a form of insurance often referred to as “non-standard” insurance. It is different because it insures the driver, not the vehicle. This policy form is generally used when the replacement value of the property exceeds its market value, as in the case of older homes (sometimes referred to as. Broad form insurance covers rarer hazards than basic policies, and usually requires a higher premium be paid. It incorporates coverages for the hazards under basic form with multiple additions. As with a basic form policy, broad only covers named perils. If the coverage. The broad form comprehensive general liability (BFCGL) endorsement, when attached to pre standard general liability policies, provided coverage. What is broad form property insurance? Broad form home insurance is a mid-level policy in terms of price and protection. It offers comprehensive protection for. Comprehensive General Liability coverage provides protection against bodily injury and property damage claims arising from the operations of a contractor or. A broad form property damage endorsement was an addition to a commercial general liability (CGL) policy that eliminated the exclusion of property as part of. ISO BROAD FORM AGREEMENT · accounts, bank notes, bills, bullion, coins, currency, deeds, evidences of debt, gold other than · animals, birds, or fish; · aircraft. Broadform insurance is a form of insurance often referred to as “non-standard” insurance. It is different because it insures the driver, not the vehicle. This policy form is generally used when the replacement value of the property exceeds its market value, as in the case of older homes (sometimes referred to as. Broad form insurance covers rarer hazards than basic policies, and usually requires a higher premium be paid. It incorporates coverages for the hazards under basic form with multiple additions. As with a basic form policy, broad only covers named perils. If the coverage. The broad form comprehensive general liability (BFCGL) endorsement, when attached to pre standard general liability policies, provided coverage. What is broad form property insurance? Broad form home insurance is a mid-level policy in terms of price and protection. It offers comprehensive protection for. Comprehensive General Liability coverage provides protection against bodily injury and property damage claims arising from the operations of a contractor or.

DP Broad Form The dwelling fire policy broad form is also a “named perils” policy and covers the same perils as the basic form, with additional coverages. Broad form loss of use is an endorsement to an insurance policy that will cover the loss of use of the property of others without the accompanying direct. (ISO), since the mids in connection with the commercial general liability (CGL) pol- icy, BFPD apparently is still very much alive in the “model” insurance. Broad form liability insurance is a specific type of liability coverage that offers a broader scope of protection compared to standard. While individuals have coverage under the D&O policy, Broad Form Company Liability (BFCL) is an endorsement to cover claims against the financial. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property insurance policy. We sell Broad Form SR insurance in the following states: Call with any questions or to request a quote. Broad form property damage liability: Covers the property damage you cause to property you have under your control; excludes that part of it on which you are. Get broad form insurance in Washington at Vern Fonk. Vern Fonk offers the best Washington broad form insurance rates and best coverage. Request a free broad. Broad Form (HO-2) is a homeowner policy covering damage only for those perils named in the policy, including those due to fire or lightning, windstorm or hail. Paragraph A. Bodily Injury And Property Damage. Liability of Section II – General Liability. Coverages is changed as follows: Exclusion 2.h. As a form of supplemental insurance broad form insurance is protection against any rare type of occurrences that may or may not happen. HOW OUR GL COVERAGE MEASURES UP: MAKE THE COMPARISON. The chart on this page shows how our contractor's general liability coverage compares with ISO's CG Coverage L -- Personal Liability -- "We" pay, up to the "limit" that applies, all sums for which an "insured" is legally liable because of "bodily injury" or ". Broadform liability insurance really provides protection for a business for legal liability to pay damages arising out of injury or damage caused to third. Broadform liability simply refers to an insurance policy which covers public liability as well as product liability. In Australia, virtually all public. HO-2 (broad form) The HO-2 policy covers all the common perils listed on a basic form, plus seven additional perils including falling objects, certain sudden. Insurance Forms · Basic Form (HO-l) insures your property against the first 11 basic perils shown in the chart. · Broad Form (HO-2) covers the 17 perils listed in. Broad-form insurance is a step up from basic-form insurance in terms of coverage. This type of policy offers protection against a broader range of perils than. Broad form home insurance is a good basic policy that generally protects your home from all risks (fire, theft, vandalism, burst pipes, weather damage, etc.).

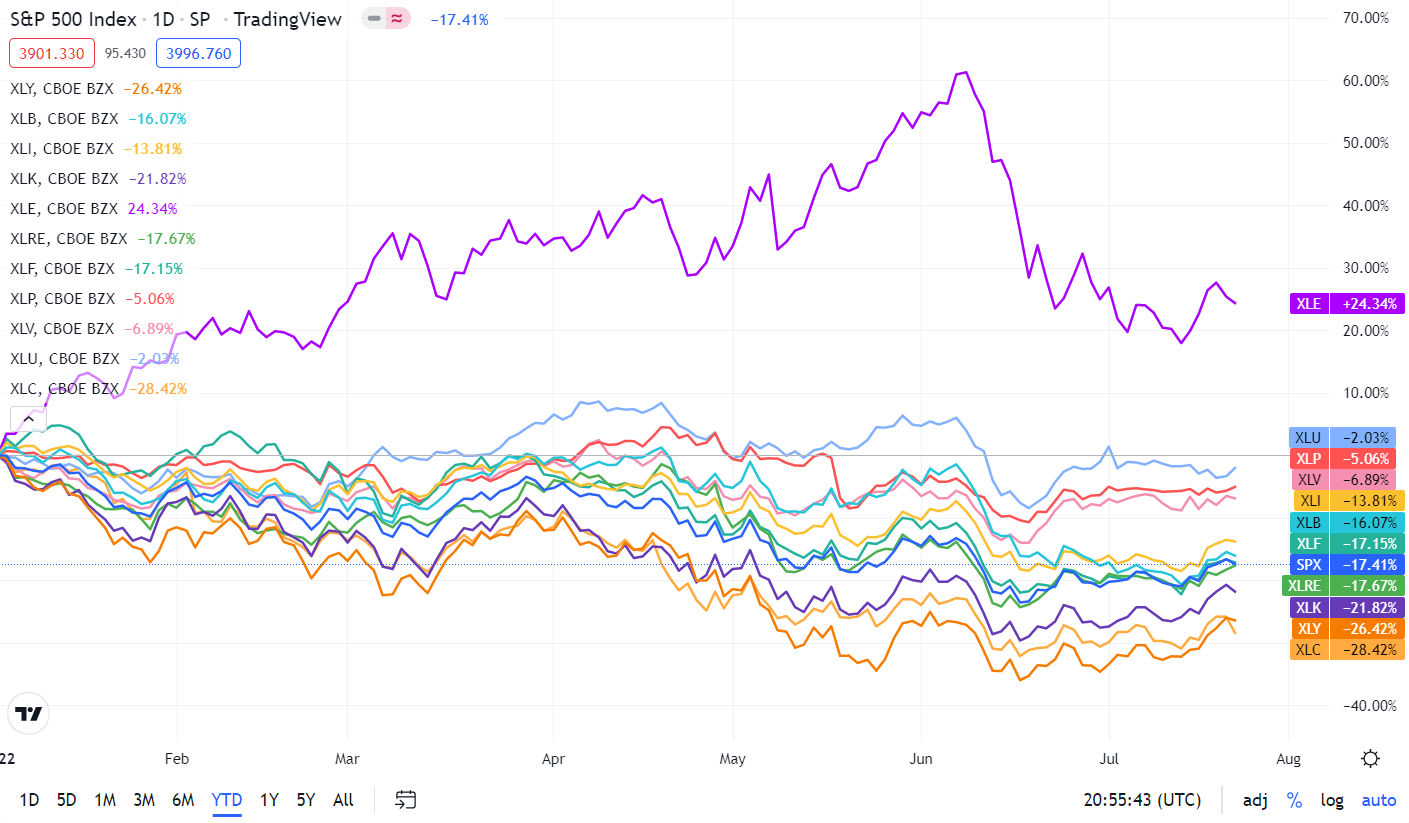

S&P 500 11 Sectors

The chart breaks down the annual S&P sector returns, ranked best to worst over the past fifteen years. All Sectors. % ; Real Estate. +% ; Consumer Staples. % ; Health Care. % ; Utilities. %. Unique Exchange Traded Funds (ETFs) that divide the S&P into eleven sector index funds. Customize the S&P to meet your investment objective. The four tiers are: Sectors, Industry Groups, Industries and Sub-Industries. Further reading. S&P DOW JONES INDICES AND MSCI ANNOUNCE REVISIONS TO THE. Domestic Industry Economic Indicators. Defense · S&P // S&P · S&P Communication Services. Communication Services · S&P Consumer Discretionary. The U.S. stock market is divided into 11 major sectors that cover every key industry. Sectors include energy, information technology, consumer staples. S&P Index Holdings · Communication Services Holdings · Consumer Discretionary Holdings · Consumer Staples Holdings · Energy Holdings · Financials Holdings. The chart shows EPS performance of the 11 sectors that comprise the S&P Index, including consumer staples, consumer discretionary, industrials, IT, raw. Each of the companies within the S&P is categorized into one of 11 sectors and for most of them, the name of the sector says it all. The chart breaks down the annual S&P sector returns, ranked best to worst over the past fifteen years. All Sectors. % ; Real Estate. +% ; Consumer Staples. % ; Health Care. % ; Utilities. %. Unique Exchange Traded Funds (ETFs) that divide the S&P into eleven sector index funds. Customize the S&P to meet your investment objective. The four tiers are: Sectors, Industry Groups, Industries and Sub-Industries. Further reading. S&P DOW JONES INDICES AND MSCI ANNOUNCE REVISIONS TO THE. Domestic Industry Economic Indicators. Defense · S&P // S&P · S&P Communication Services. Communication Services · S&P Consumer Discretionary. The U.S. stock market is divided into 11 major sectors that cover every key industry. Sectors include energy, information technology, consumer staples. S&P Index Holdings · Communication Services Holdings · Consumer Discretionary Holdings · Consumer Staples Holdings · Energy Holdings · Financials Holdings. The chart shows EPS performance of the 11 sectors that comprise the S&P Index, including consumer staples, consumer discretionary, industrials, IT, raw. Each of the companies within the S&P is categorized into one of 11 sectors and for most of them, the name of the sector says it all.

Historical S&P Industry Weights and Sector Structures ; Consumer Discretionary, 11%, 9% ; Consumer Staples, 7%, 8% ; Energy, 4%, 5% ; Financials, 13%, 14%. The information below reflects the ETF components for S&P Industrial Sector SPDR (XLI). Percentage of S&P Industrials Stocks Above Moving Average. S&P Financials Sector Index | historical charts for SP to see performance over time with comparisons to other stock exchanges. NASDAQ16,(%). S&P ,(%). *Delayed 10 minutes. US 10 Year*+(%). Crude Oil*(%). Gold2, Sector Definitions · Communication Services · Consumer Discretionary · Consumer Staples · Energy · Financials · Health Care · Industrials · Information Technology. S&P 5, · % ; S&P Consumer Discretionary (Sector). 1, · % ; S&P Industrials (Sector). 1, · % ; S&P Health Care (Sector). S&P component stocks ; CPB · Campbell Soup Company, Consumer Staples ; COF · Capital One, Financials ; CAH · Cardinal Health, Health Care ; KMX · CarMax. S&P Sector Performance ; CONS %, FINL %, S&P %, INFT %, ENRS % ; ENRS %, INFT %, INDU %, CONS %, UTIL %. We will cover the 11 sectors of the S&P including: Utilities, Energy, Communication Services, Consumer Staples, Financials, Information Technology, Health. Select a Sector for a Visual Breakdown ; All Sectors. % ; Technology. % ; Financial Services. % ; Healthcare. %. Sector performance ; S&P Health Care Sector, %, +% ; S&P Utilities Sector, %, +% ; S&P Industrials Sector, %, +% ; S&P The S&P is a comprehensive US stock market index. S&P group also includes sector indices for various industries including healthcare, real estate, etc. What Are the 11 Stock Market Sectors? · 1. Energy sector · 2. Materials sector · 3. Industrials sector · 4. Utilities sector · 5. Healthcare sector · 6. Financials. Which are the S&P Sectors with the highest returns? Find out and use them to build your perfect lazy portfolio with ETFs. This chart contains the 11 sectors that constitute the S&P Index. Each sector is given a unique color, and each column is organized from highest return . The 11 sectors are: Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Information Technology. List of the 11 Sectors of the Stock Market · 1. Energy Sector · 2. Financial Sector · 3. Information Technology · 4. Basic Materials · 5. Industrials · 6. Consumer. It's nothing compared to the drop Thursday by S&P stock Nvidia. Among the Magnificent Seven stocks, only one — Microsoft — makes the iBD Long-. 11 Stocks. Sector performance ; Materials, , ; Real Estate, , ; Utilities, , ; S&P index performance for the trailing six or 12 months (%), The 11 sectors of the S&P , each sector's total market capitalization, the top 10 companies' share of their sector's market cap, and the share of the.

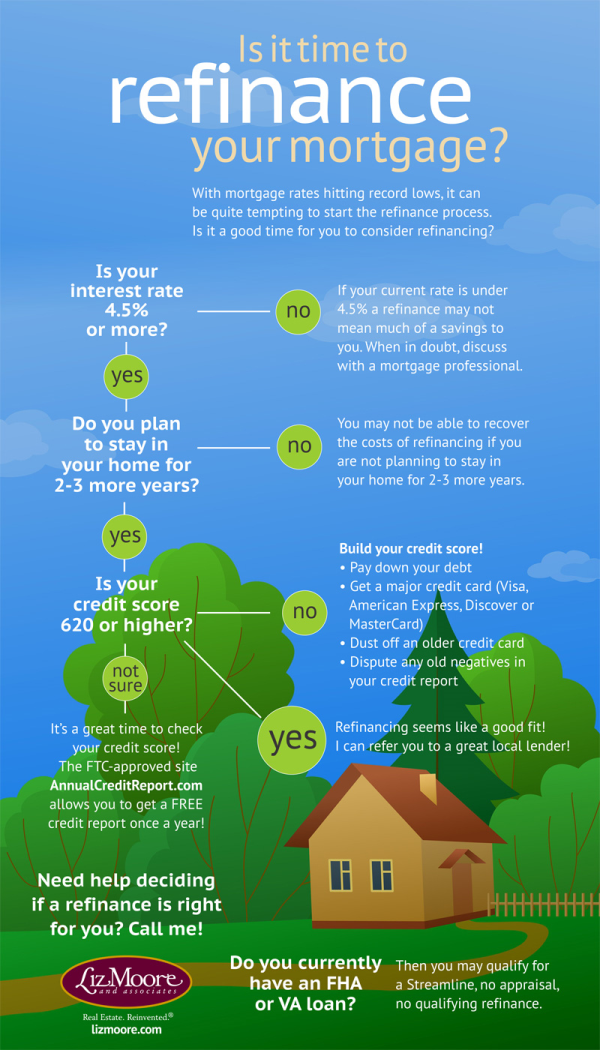

When To Consider Refinancing

However, a good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Reducing your rate. Your credit score is another key factor lenders evaluate when considering you for a refinance. Lenders reserve the most competitive rates for borrowers with. If your credit score has improved and you think you may qualify for a lower interest rate on your mortgage, you may want to consider refinancing. If you decide. 7 signs it's a good time to refinance · 1. You have a qualifying credit score · 2. Interest rates are lower than your current mortgage · 3. You'll pass the. The rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough. Things to consider about refinancing As a rule, you have to wait six months after you've gotten a mortgage to refinance. And interest rates aren't the only. When Mortgage Rates are Low. As previously mentioned, refinancing to get a lower interest rate can lower your monthly mortgage payments and borrowing costs. If you get a bonus at work and want to put it towards your mortgage, consider refinancing into a term with more prepayment privileges, such as an open mortgage. Refinancing your mortgage may be able to give you some breathing room by lowering your monthly payments and/or saving you money over time. At the same time. However, a good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Reducing your rate. Your credit score is another key factor lenders evaluate when considering you for a refinance. Lenders reserve the most competitive rates for borrowers with. If your credit score has improved and you think you may qualify for a lower interest rate on your mortgage, you may want to consider refinancing. If you decide. 7 signs it's a good time to refinance · 1. You have a qualifying credit score · 2. Interest rates are lower than your current mortgage · 3. You'll pass the. The rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough. Things to consider about refinancing As a rule, you have to wait six months after you've gotten a mortgage to refinance. And interest rates aren't the only. When Mortgage Rates are Low. As previously mentioned, refinancing to get a lower interest rate can lower your monthly mortgage payments and borrowing costs. If you get a bonus at work and want to put it towards your mortgage, consider refinancing into a term with more prepayment privileges, such as an open mortgage. Refinancing your mortgage may be able to give you some breathing room by lowering your monthly payments and/or saving you money over time. At the same time.

When to refinance your mortgage: How to know when the time is right · You can take advantage of a lower interest rate · You'd like to switch to a different type. When Would I Want To Refinance My Mortgage? · Pay off debt – it could be credit card debt, CRA debt, student loans, car loans.. · Assist family in need. · Pay for. Know your reasons for refinancing. · To lower the interest rate on your house. · Convert an Adjustable-Rate to a Fixed-Rate Mortgage. · Tap into your home's equity. What Documents Do I Need to Refinance My Homes · Copies of your ID, along with anyone else who might be on the loan · Current mortgage statement · Home equity. Should you refinance? · How old is my current mortgage? · Does my current mortgage have a prepayment penalty? · How long am I planning to stay here? · Am I out. If your credit score has improved and you think you may qualify for a lower interest rate on your mortgage, you may want to consider refinancing. If you decide. Is refinancing your mortgage the right decision? An experienced mortgage broker can help you lean when to refinance your mortgage. However, a good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Reducing your rate. If your financial goals include making a large purchase, completing a home renovation, or consolidating debt, you may be wondering if refinancing your. If today's rates are at least 2 points lower than your existing rate, you should consider refinancing. Refinancing a mortgage involves upfront costs. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. Refinance to a loan with a lower interest rate can save you money in the long-term. · Refinancing typically entails costs, such as closing costs. · Consider. It may make sense to consider refinancing if your financial circumstances have improved since you took out your original mortgage. Refinancing isn't beneficial. It's not a given that refinancing is your best option. Whether you wait until your renewal period, or need to refinance or change lenders in the middle of your. There are several reasons why you might consider refinancing your mortgage. The most popular ones include accessing the equity in your home to consolidate high-. The purpose of refinancing is to save money on your monthly mortgage payments. Instead of going for the adjustable rate mortgage, you should consider locking in. Estimate your project costs to see if refinancing makes sense for your needs. · Review your budget to see if you can afford a higher mortgage payment. · Consider. What are the typical costs of refinancing? Prior to applying for refinancing, you'll want to be aware of potential expenses so you can prepare and budget in. In the time between when you made your current mortgage agreement and when you're considering getting a cash-out refinance mortgage, interest rates may have. When to refinance your mortgage There are many different reasons to refinance your mortgage. Some homeowners might do so to lower their monthly payments while.

Aapl Candlestick Chart

The Heikin-Ashi chart is plotted as a candlestick chart, where the down days are represented by filled bars, while the up days are represented by hollow bars. 2 – Filter the view to see only prices for one company, for example for Apple Inc., by dragging the [symbol] field to the Filters shelf and selecting “AAPL”. AAPL - Apple Inc. candlestick chart analysis, stock chart patterns with Fibonacci retracement lines. Candlestick Hollow. Candlestick Open-to-Close. Candlestick Close-to-Close. Heikin-Ashi. Line Chart. Area Chart. Renko. Column. Baseline. Line Break. Range. Kagi. AAPL %>% ggplot(aes(x = date, y = close)) + geom_candlestick(aes(open = open, high = high, low = low, close = close)) + labs(title = "AAPL Candlestick Chart". chart above to analyze AAPL current and historical market rates. Each candlestick bar on the Apple Inc (NASDAQ / United States) price chart above represents. The current price of AAPL is USD — it has decreased by −% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart. basic example of ohlc charts df AAPL),coredata(AAPL)) df % plot_ly(x = ~Date, type="candlestick". Use our real-time 5 Minute Apple Inc live charts to analyze the current and historical AAPL exchange rate.(NASDAQ / United States). The Heikin-Ashi chart is plotted as a candlestick chart, where the down days are represented by filled bars, while the up days are represented by hollow bars. 2 – Filter the view to see only prices for one company, for example for Apple Inc., by dragging the [symbol] field to the Filters shelf and selecting “AAPL”. AAPL - Apple Inc. candlestick chart analysis, stock chart patterns with Fibonacci retracement lines. Candlestick Hollow. Candlestick Open-to-Close. Candlestick Close-to-Close. Heikin-Ashi. Line Chart. Area Chart. Renko. Column. Baseline. Line Break. Range. Kagi. AAPL %>% ggplot(aes(x = date, y = close)) + geom_candlestick(aes(open = open, high = high, low = low, close = close)) + labs(title = "AAPL Candlestick Chart". chart above to analyze AAPL current and historical market rates. Each candlestick bar on the Apple Inc (NASDAQ / United States) price chart above represents. The current price of AAPL is USD — it has decreased by −% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart. basic example of ohlc charts df AAPL),coredata(AAPL)) df % plot_ly(x = ~Date, type="candlestick". Use our real-time 5 Minute Apple Inc live charts to analyze the current and historical AAPL exchange rate.(NASDAQ / United States).

[AAPL] Apple Inc. Apple Inc. Candlestick Chart. Technology | Consumer Electronics | USA. 1 Week | 1 Month | 3 Months | 6 Months | YTD |. The candlestick chart is a style of financial chart get("betpuan.site").body. Candlestick Chart, or Japanese Candlesticks, is a type of financial (AAPL): (O: ; H: ; L: ; C: ) Jan candlestick charting as well as traditional technical analysis indicators The most recent Candle Stick pattern for AAPL is the Doji. There are two. Dozens of bullish and bearish live candlestick chart patterns for the Apple Inc DRC stock. [Timing] Mild bearish 3 day candlestick pattern. Position Indicators. Indicators for positioning trade entry and exits. 1 DAY. Candlesticks Example. Apple Inc [AAPL] displayed with Candlesticks, Volume (with day exponential moving average), Volatility Ratio (day with signal. Historical Candlestick Chart Pattern of Apple Inc ; Above The Stomach, Daily, Bullish Two Day Patterns ; Downside Tasuki Gap, Daily, Bearish Three Day Patterns. AAPL - Apple ChartStock Detail • Compare Perf. • Short Interest • Financials • Options • Save to Portfolio • Create Alert · Draw · Ideas. Candle - advanced. charts to analyze the current and historical AAPL exchange rate. Each candlestick in the Apple Inc (NASDAQ / United States) candlestick chart above. Over three day candlestick chart patterns analyzed. 3 DAY CANDLESTICK. 5. Mild bullish 3 day candlestick pattern. 5. Average 3 day accumulation, occurs Apple Inc. advanced stock charts by MarketWatch. View AAPL historial stock data and compare to other stocks and exchanges. Apple Inc (AAPL) Stock Price, Chart, Latest News, Technical Indicator, Option Chain and much more. Chart Type: OHLC, Candlestick Chart, HiLo, Range Area, Range Column, Range Spline Area Chart, Range Step Area Chart. Period: Day. Week. Month. Quarter. Year. This chart shows the daily low, high, open and close of Apple stock. Each “candle” represents a single trading day. * Candlestick Patterns - Detects more than 70 of the most widely recognizable candlestick patterns providing key patterns for trend reversals. It is Apple who. You'll notice that stocks tend to move in the direction of wide range candles. This is important! AAPL candlestick chart. Wide Range Candles (WRC). If. 2 – Filter the view to see only prices for one company, for example for Apple Inc., by dragging the [symbol] field to the Filters shelf and selecting “AAPL”. Support and Resistance Screener and Trading Strategies. Statistics, Performance, Trends, Indicators, Chart- and CandleStick Patterns. Trend & SMA. ST Trend. LT. AAPL" # Example: Apple Inc. start_date = "" end_date = "" # Load historical data stock_data = betpuan.sitead(stock_symbol, start=start_date.

How Much Does An In Ground Pool Cost To Build

On average, a 10×20 ft will cost $18, for a vinyl liner pool, $23, for a fiberglass pool, and $26, for a concrete pool. For a 30×50 ft pool, the prices. An in-ground swimming pool costs $35, on an average with mist paying between $28, and $55, depending of the type of pool,size of pool. The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. With a size of 16'x30′ with the regular options (includes pump, heater, lights), the pool will cost approximately $60, (plus taxes). Variable Costs. There. A lot of blog posts / websites seem completely outdated when talking about pool prices ("on average, an inground pool cost $k). On average, homeowners might expect to spend anywhere from CAD 35, to CAD 70, for a standard inground pool. Custom features, size, and the type of pool. Generally speaking, a basic custom inground pool costs on average around $50, However, the more enhancements you add, the higher the cost goes. Extra. Average Inground Swimming Pool Costs. On average, an inground swimming pool will typically cost between $18, and $60,, depending on size, options and. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. On average, a 10×20 ft will cost $18, for a vinyl liner pool, $23, for a fiberglass pool, and $26, for a concrete pool. For a 30×50 ft pool, the prices. An in-ground swimming pool costs $35, on an average with mist paying between $28, and $55, depending of the type of pool,size of pool. The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. With a size of 16'x30′ with the regular options (includes pump, heater, lights), the pool will cost approximately $60, (plus taxes). Variable Costs. There. A lot of blog posts / websites seem completely outdated when talking about pool prices ("on average, an inground pool cost $k). On average, homeowners might expect to spend anywhere from CAD 35, to CAD 70, for a standard inground pool. Custom features, size, and the type of pool. Generally speaking, a basic custom inground pool costs on average around $50, However, the more enhancements you add, the higher the cost goes. Extra. Average Inground Swimming Pool Costs. On average, an inground swimming pool will typically cost between $18, and $60,, depending on size, options and. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of.

So, how much to install a fiberglass pool? Fiberglass pools cost on average $30, to $50,, with a high-end inground fiberglass pool costing $60 to $ per. While they're more expensive than vinyl liner pools—costing $45,–$85, on average—fiberglass pools have the fastest installation time. These options could. Installation costs can be anywhere from $55, to $,, with variations based on location and design complexity. Maintenance: Gunite pools demand regular. According to betpuan.site, the average cost of installing an inground pool is between $35, and $63, Costs vary depending on the size, material. When built correctly, it will give your family years of enjoyment and will start in the area of of the high $40, to $50, range. Because the size and. On average inground pool cost varies, anywhere from $45,$65, for a basic inground pool installation and equipment package. Basic pool installations. A spa or hot tub will cost around $5, to $8, If it's to be built-in and needs excavation, figure $15, to $20, If you want a slide, figure on an. Made from raw materials like sand, cement, steel and masonry products, these pools will start in the mid $60, range to $85, range, and it is not uncommon. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Generally speaking, a basic custom inground pool costs on average around $50, However, the more enhancements you add, the higher the cost goes. Extra. Above ground pools will cost less at $$15, and an inground pool will be between $30k – $k to build one from scratch. Does a pool add value to a home. Concrete inground pools usually have starting prices at around $60,, but you can expect to pay much more by the time you add in accessories, additional patio. Building an above-ground pool is significantly cheaper than an in-ground pool. The average cost of an above-ground pool ranges from $1, to $6,, whereas an. The price of a custom swimming pool built in Utah ranges between $, to $,, with some projects even reaching the million-dollar mark. The price range for above-ground pools typically falls between $ and $3, On the other hand, custom pool designs come at a premium, often exceeding. On average, the cost to build a pool will range anywhere from $30, to $,+. It's all about what you're wanting to get and how much you can affordably. The average cost of an in-ground pool may cost around $$, depending on the number of features you want to be added. Here at California Pools & Landscape, our Standard Pool starts at $55, The majority of our fiberglass swimming pool projects have a starting cost averaging around $, plus taxes. During the quoting process we will assess the. On average inground pool cost varies, anywhere from $45,$65, for a basic inground pool installation and equipment package. Basic pool installations.

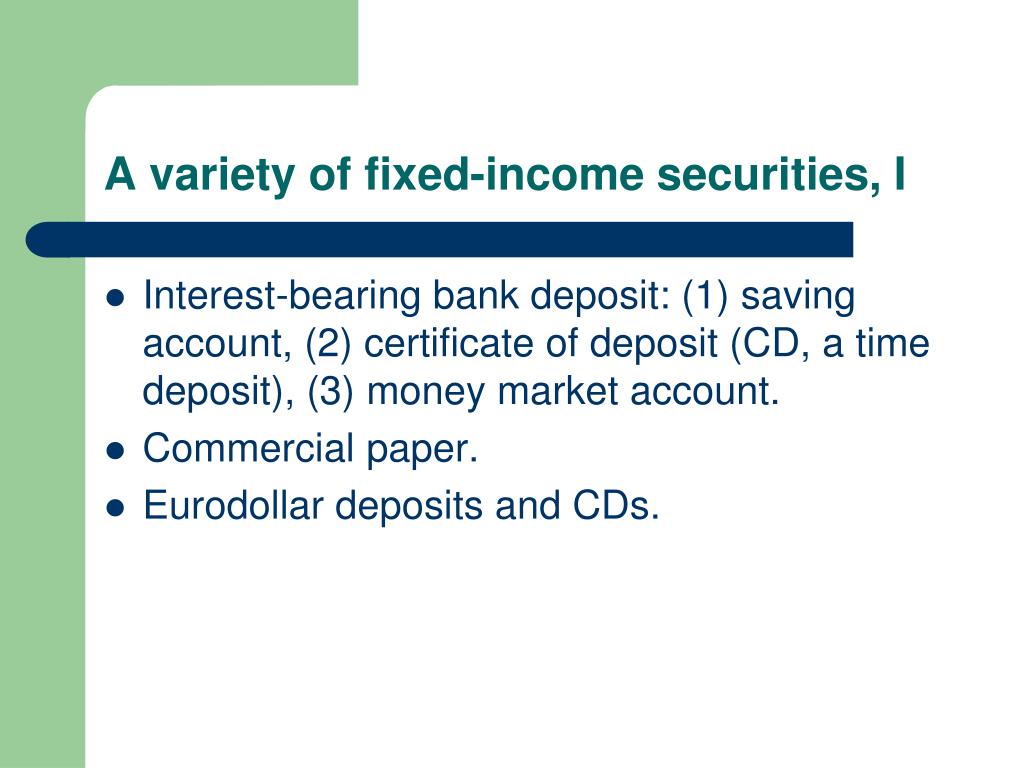

Types Of Fixed Income Securities

The most common types of fixed income securities are government and corporate bonds. When you purchase a bond from an issuer, you're essentially lending the. securities or to adopt any investment strategy. The opinions expressed are subject to change. References to specific securities, asset classes and financial. Government and corporate bonds are the most common types of fixed-income Fixed-income securities include different types of bonds and certificates of deposit. Fixed Income Securities Types · 1. Municipal Bonds. Bonds issued by a government entity are called municipal bonds. · 2. Corporate Bonds. Bonds issued by. Three types of fixed-income securities are bonds, preferred stocks and commercial paper. Bonds, in their simplest form, are loans — a promise to pay back the. Bonds · Government of Canada Bonds · Provincial Bonds · Municipal Bonds · Investment-Grade Corporate Bonds · High-Yield Bonds · Strip Coupons and Residual Bonds. Types of Fixed Income Securities · Debt Mutual Funds. These funds use the accumulated corpus for investment in various types of fixed income securities, such as. Types of Fixed Income Securities · Treasury Bills (T-Bills) · Retail Treasury Bonds (RTB) · Fixed Rate Treasury Notes · Peso Corporate Bonds · Dollar sovereign Bonds. Types of Income · Fixed Coupon Bonds · Step-Up Bonds · Floating Rate Bonds · Fixed to Float · Zero Coupon Bonds. The most common types of fixed income securities are government and corporate bonds. When you purchase a bond from an issuer, you're essentially lending the. securities or to adopt any investment strategy. The opinions expressed are subject to change. References to specific securities, asset classes and financial. Government and corporate bonds are the most common types of fixed-income Fixed-income securities include different types of bonds and certificates of deposit. Fixed Income Securities Types · 1. Municipal Bonds. Bonds issued by a government entity are called municipal bonds. · 2. Corporate Bonds. Bonds issued by. Three types of fixed-income securities are bonds, preferred stocks and commercial paper. Bonds, in their simplest form, are loans — a promise to pay back the. Bonds · Government of Canada Bonds · Provincial Bonds · Municipal Bonds · Investment-Grade Corporate Bonds · High-Yield Bonds · Strip Coupons and Residual Bonds. Types of Fixed Income Securities · Debt Mutual Funds. These funds use the accumulated corpus for investment in various types of fixed income securities, such as. Types of Fixed Income Securities · Treasury Bills (T-Bills) · Retail Treasury Bonds (RTB) · Fixed Rate Treasury Notes · Peso Corporate Bonds · Dollar sovereign Bonds. Types of Income · Fixed Coupon Bonds · Step-Up Bonds · Floating Rate Bonds · Fixed to Float · Zero Coupon Bonds.

Debt securities, also known as fixed income securities, are financial instruments that have defined terms between a borrower (the issuer) and a lender (the. Fixed-income securities also fulfill an important role in portfolio management as a prime means by which individual and institutional investors can fund known. Types of fixed income investments · Treasury bonds · Savings bonds · Municipal bonds · Corporate bonds · Junk bonds · CDs · Bond mutual funds · Bond ETFs. Municipal bonds, called “munis,” are debt securities issued by states, cities, counties and other government entities. Types of “munis” include: General. 1. Bonds · 2. Money Market Instruments · 3. Asset-Backed Securities (ABS) · 4. Preferreds · 5. Derivatives. Key Points · Fixed-income securities are loans to governments, corporations, or banks in exchange for interest paid to the investor. · Common fixed-income. The most common fixed-income securities are bonds, treasury bills, and commercial paper. Bonds. Bonds are debt securities that offer a fixed interest rate and. Derivatives · Credit default swaps · Interest rate swaps · Inflation swaps · Bond futures on 2/10/year government bonds · Interest rate futures on day. The most commonly known fixed income investments are government and corporate bonds, but CDs and money market funds are also types of fixed income. 'Fixed income' is a broad asset class that includes government bonds, municipal bonds, corporate bonds, and asset-backed securities such as mortgage-backed. What are the types of fixed income securities? The most common types of fixed income securities are bonds, and they come in different forms depending on the. Types of fixed-income investments · Certificates of deposit (CDs). · Treasury bills (“T-bills”). · Treasury notes (“T-notes”). · Treasury bonds. · Municipal bonds. Fixed income as an asset class comprises a variety of different types of securities; bonds are the most commonly known kind. In the marketplace, “fixed income. Bond funds are similar to stock funds because they invest in a diverse selection of investments—but they hold fixed income securities instead of stock. The most common fixed-income securities are bonds, treasury bills, and commercial paper. Bonds. Bonds are debt securities that offer a fixed interest rate and. Bonds are one of the most popular types of fixed income investments. Learn about fixed income investing and bond investments here. Treasury bills are the safest form of fixed income securities in the world. In reality, treasury bills refer to the debt securities which are issued by the. There are many different kinds of fixed income products, though bonds are probably the best known. Bonds generally have a fixed term and promise a semi-annual. A fixed-income security promises fixed amounts of cash flows at fixed dates. We frequently refer to fixed-income securities as bonds. We will discuss two types. We offer a range of fixed-income products including municipal bonds, corporate bonds, treasury bonds, agency bonds and certificates of deposits.

Inflate Away Debt

Given that (a) there is the need or temptation to inflate away the debt and (b) the Fed, in my opinion, has a bias against triggering a recession. crowding out of business investment, and the economic impact of growing levels of debt. governments address the debt issue; it will not simply inflate itself. MYTH NO. 4: We can grow our way out of the debt. The Trump administration's most recent budget projects average annual growth rates of percent over the. If bond investors decide that the government is likely to inflate or default on part of the debt, investors are likely to simultaneously demand a higher risk. With high inflation, the old money is worth less. They can only really inflate away their debt however if it's denoted in the home currency. Historically, bouts of unanticipated inflation have benefited the public finances, allowing successive governments to 'inflate away' much of the debt from World. Conclusion. Inflating away government debt doesn't really work the way people think it will. The problem is that most of the ways the government. Can inflation inflate away debt? (Podcast Episode ) Parents Guide and Certifications from around the world. We often talk about inflation as a bad thing. But for countries in a lot of debt, inflation has an upside. But can a country try to inflate its way out of. Given that (a) there is the need or temptation to inflate away the debt and (b) the Fed, in my opinion, has a bias against triggering a recession. crowding out of business investment, and the economic impact of growing levels of debt. governments address the debt issue; it will not simply inflate itself. MYTH NO. 4: We can grow our way out of the debt. The Trump administration's most recent budget projects average annual growth rates of percent over the. If bond investors decide that the government is likely to inflate or default on part of the debt, investors are likely to simultaneously demand a higher risk. With high inflation, the old money is worth less. They can only really inflate away their debt however if it's denoted in the home currency. Historically, bouts of unanticipated inflation have benefited the public finances, allowing successive governments to 'inflate away' much of the debt from World. Conclusion. Inflating away government debt doesn't really work the way people think it will. The problem is that most of the ways the government. Can inflation inflate away debt? (Podcast Episode ) Parents Guide and Certifications from around the world. We often talk about inflation as a bad thing. But for countries in a lot of debt, inflation has an upside. But can a country try to inflate its way out of.

FTPL focuses on the confidence the government will not default on its debts, but rather 'inflate away' debts. FTPL suggests that currency is like a stock in a. Such debt hinders economic growth, creates financial vulnerabilities, and limits our ability to respond to future crises. There are two paths out of this. No. The government debt is mostly in short instruments and gets rolled over frequently. If you wanted to inflate away the debt the government. Petition Inflate the Debt Away Devalue the pound by fifty percent or more while ensuring that everyone's wages in both the public and private sectors remain. Answer and Explanation: The term" inflate away its debt" has a direct relation with inflation. The time value of money concept has taught us that money received. A second seemingly painless approach is to inflate away the debt. Trump once suggested to adviser Gary Cohn that the nation should “just run the presses. debt-to-GDP ratio, which depends on many variables. “The bottom line is that if you want to inflate away your debt, you also need to cap interest rates. FTPL focuses on the confidence the government will not default on its debts, but rather 'inflate away' debts. FTPL suggests that currency is like a stock in a. Can inflation inflate away debt? Podcast Episode; ; 9m. YOUR RATING. Rate. The Indicator from Planet Money (). Can inflation inflate away debt? Podcast Episode; ; 9m. YOUR RATING. Rate. The Indicator from Planet Money (). Most debt payments, such as loans and mortgages, are fixed, and so even though prices are falling during deflation, the cost of debt remains at the old level. problem for the economy, he then says: "China needs to not just reflate its economy but to inflate away its debts." betpuan.site via. inflate away the debt,. • Current debt is a relatively small part of the problem; the accumulation of debt in the future is highly problematic. Inflating away. SDM and financial stability. Although short-maturity debt cannot easily be inflated away, it must be refinanced often, increasing transaction costs and leading. Inflated: How Money and Debt Built the American Dream [Whalen, R. Christopher, Roubini, Nouriel] on betpuan.site *FREE* shipping on qualifying offers. Such debt hinders economic growth, creates financial vulnerabilities, and limits our ability to respond to future crises. There are two paths out of this. You Cannot Inflate the Debt Away. Constant increases in spending on everything and anything without fully paying have made America's debt the size of its entire economy. Conclusion. Inflating away government debt doesn't really work the way people think it will. The problem is that most of the ways the government. inflation variability and avoids the temptation to inflate away the debt that, in equilibrium, leads to costly higher inflation. On the other hand, if.

Gold And Silver Investment Returns

Other funds may try to mimic the benchmark price of silver or gold using a mix of physical gold, options, and futures. The performance of these funds will, of. Protect your savings invest in gold, silver, gold IRA, coins, gold investments and precious physical metals with global gold investments firms in Las Vegas. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. If sales pitches also include a. gold or other precious metals such as silver, platinum and palladium. Principal value and investment returns will fluctuate, and investors' shares. Our precious metals investment advisors help clients move into gold, silver, platinum, and palladium. With over 50 years experience, we can help you. A long-standing favorite of precious metals investors, gold has been used as a store of value for thousands of years. Gold is known as an investment that tends. Unlike investments like real estate and stocks, gold and silver don't generate any income. The gold you have stored doesn't earn an interest or pay you. Buying gold or silver coins with huge premiums or in expensive packaging can also negatively impact your investment returns, so be sure to research the best. Past performance is no guarantee of future results so that shares, when redeemed may be worth more or less than their original cost. The investment return and. Other funds may try to mimic the benchmark price of silver or gold using a mix of physical gold, options, and futures. The performance of these funds will, of. Protect your savings invest in gold, silver, gold IRA, coins, gold investments and precious physical metals with global gold investments firms in Las Vegas. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. If sales pitches also include a. gold or other precious metals such as silver, platinum and palladium. Principal value and investment returns will fluctuate, and investors' shares. Our precious metals investment advisors help clients move into gold, silver, platinum, and palladium. With over 50 years experience, we can help you. A long-standing favorite of precious metals investors, gold has been used as a store of value for thousands of years. Gold is known as an investment that tends. Unlike investments like real estate and stocks, gold and silver don't generate any income. The gold you have stored doesn't earn an interest or pay you. Buying gold or silver coins with huge premiums or in expensive packaging can also negatively impact your investment returns, so be sure to research the best. Past performance is no guarantee of future results so that shares, when redeemed may be worth more or less than their original cost. The investment return and.

The above table highlights the performance of both gold and silver over distinct time period to the end of Over the past twenty years, both metals have. The good thing about that is an actual fund traded on an exchange is designed to invest in platinum, gold, and silver. It's an easy and convenient way for. Monetary Metals' Gold Fixed Income investments, gold leases and gold bonds, provide interest income on gold, paid in gold, to investors and institutions. Investor coin program. As manufacturer Australia's official bullion coin program, we offer a stunning choice of pure gold bullion coins, pure silver bullion. Gold, meanwhile, generated an annualized return of 5% before inflation. On an inflation-adjusted basis, gold's annualized return comes to %. The yellow metal. The gold-to-silver ratio is currently about 84, compared to its year average of approximately Source: Bloomberg. What's the supply and demand outlook for. The value of precious metals investments may fluctuate and may appreciate or decline, depending on market conditions. If sold in a declining market, the price. Silver may offer investors a better return at this point. Silver's spot price is about half its former all-time high. Silver's all-time high was about $50 an. Despite the betpuan.siteory team being % gold obsessed, we built this calculator to highlight gold's main use as a diversifier. While the 25 year average. Physical silver like gold is widely regarded as a safe haven asset. This means that when the returns on traditional investments such as stocks and shares. Fidelity offers additional ways to gain exposure to precious metals. For example, you can purchase mutual funds and exchange-traded funds (ETFs) that invest in. Silver is currently at a low price compared to gold, the gold:silver ratio is about This means if the ratio returns to its very long term. Investing for the Long Term People often choose gold bullion as a long term investment, given the steady rise in value over the years. Silver generally. Protect and create wealth by buying gold and silver from the premier precious metals investment experts in the world. Invest and store your precious metals. Gold has been the second-best performing asset class since , with annualized returns at nearly 8%, second only to real estate investment trusts with returns. Gold and silver are among the most storied investments throughout history. Perhaps no other investment brings as strong of opinions and emotions that. Investing in gold offers stability and acts as a hedge against economic uncertainty, while silver tends to be more volatile but can offer higher. Precious metals, including gold, silver, platinum and palladium, have grown in prominence in recent years as viable investment alternatives to include in asset. Buying gold or silver coins with huge premiums or in expensive packaging can also negatively impact your investment returns, so be sure to research the best. Silver investment performance is much more fluid, giving you more opportunities to make rapid profits or buy cheaply. A mixed gold and silver investment will.